Unlock Your Path to the Perfect processing solution

Click to schedule

We'll then reach out to answer any questions you may have.

AMF Processing

In a down market, keeping as much of your commissions can make a big difference! What if you could pass

the processing fees to the borrower instead of coming from your broker compensation.

Here is what we can do for you

Saving Money It allows you to pass on the processing fee to your borrower

Flexibility Use YOUR processor OR mine

Licensed in Multiple states CA, AZ, CO, FL, TX, WA, GA, IN, LA, VA, (Pending: in OR, MI, WY, NV, TN)

We are not originators We will we never solicit any of your contacts

We can work with any broker You never have to worry again

Regular Updates

Know where the loan is at

Know what is needed next

Careful Handling

Reducing lost time

Avoiding costly mistakes

Great Communication

Ready and available

Clear goals and challenges

Frequently Asked Questions

What documents do I need to apply for a mortgage?

You’ll typically need proof of income, bank statements, tax returns, and credit information. Specific requirements may vary by lender.

How much can I borrow for my mortgage?

Your borrowing amount depends on your income, credit score, down payment, and debt-to-income ratio. A pre-approval can give you a clearer estimate.

What’s the difference between a fixed-rate and adjustable-rate mortgage?

A fixed-rate mortgage has a steady interest rate throughout the term, while an adjustable-rate mortgage (ARM) has a rate that may fluctuate after an initial fixed period.

How long does the mortgage approval process take?

The timeline can vary but generally takes 30-45 days, depending on factors like document verification, appraisals, and lender-specific processes.

Testimonials

Mike-AHL

“I use AMF to process all of my loans and I have never been let down. Professional, friendly, and efficient every time. Thank you for being a great partner AMF!"

— Mike AHL

“Anna has helped me process a few loans as well my friends too. They all went smooth and we will continue working with her company.”

— Jake

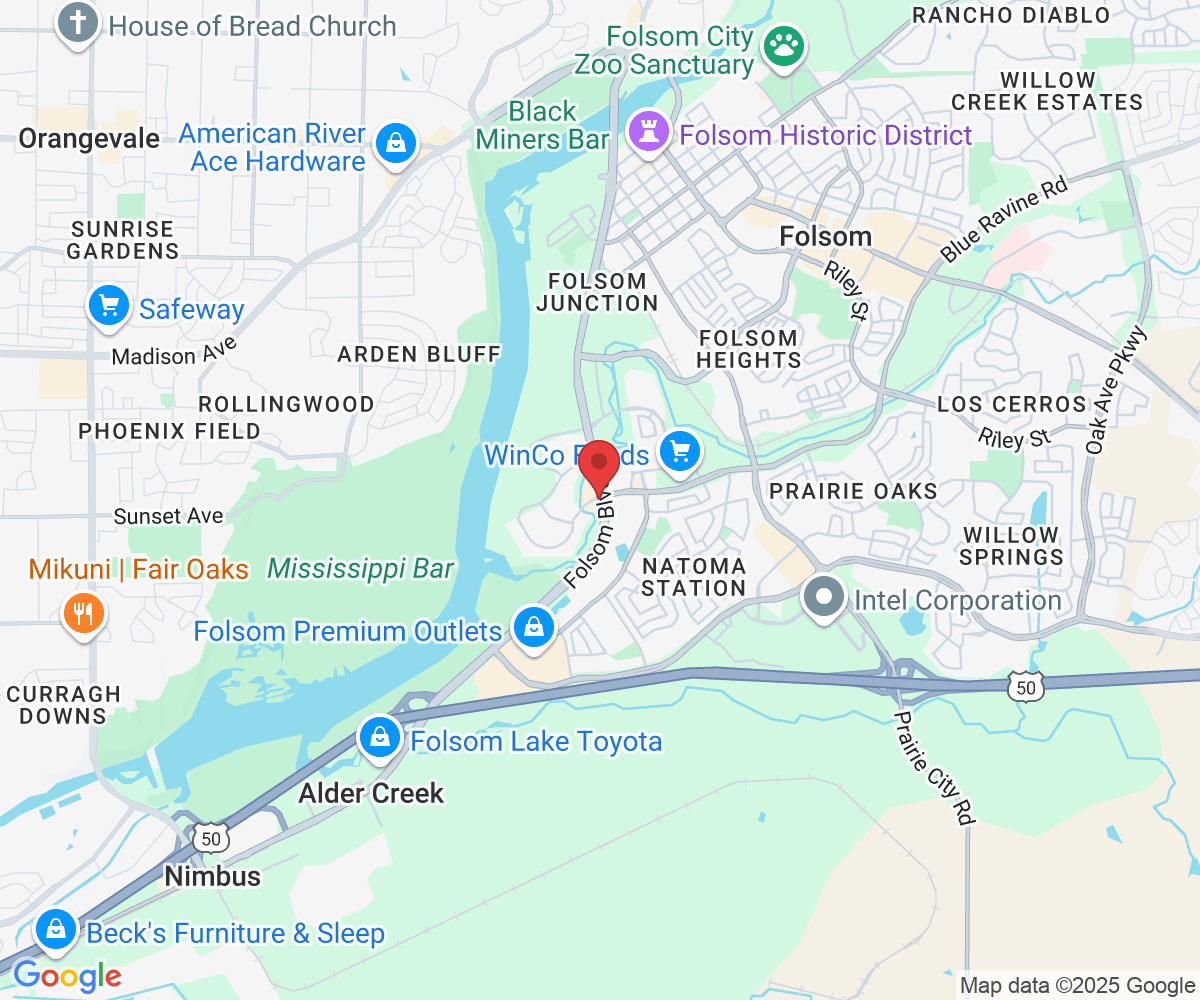

Location: 13389 Folsom Blvd Suite #300-225, Folsom CA 95630

Call (800) 815-2985

Email: [email protected]

Site: www.amf-processing.com